In the latest InfraRed+Insights article, we posed three questions on the investment trends relating to the decarbonisation of buildings to Pilar Banegas, a Partner in InfraRed’s Fund Management team.

1. Why is InfraRed looking at opportunities to deploy capital in businesses that decarbonise the built environment?

The decarbonisation of buildings is one of the next frontiers to tackle, as part of the global net zero agenda.

A 2023 McKinsey study highlighted that the construction and operation of the built environment accounted for approximately 26% of all global greenhouse gas emissions and 37% of combustion- related emissions1.

Progress to reduce emissions from the highest emitting sectors, such as the built environment, has been varied. In the UK, for example, residential emissions have remained relatively static over the past three decades in contrast to those from energy generation, which have fallen significantly over this period2.

We see many meaningful opportunities to decarbonise the built environment and the infrastructure related to it. For example, space heating and water heating emissions are, on average, roughly three-quarters of operational emissions for residential buildings, making them strong targets for change3.

The overall scale of the built environment’s emissions and the opportunities for decarbonisation makes the sector an exciting target for innovation and investment.

2. In practice, what investment opportunities are you focused on?

We are particularly interested in the interplay between the distributed generation of energy, the use of digital solutions for key building systems and new technologies to store energy and to heat buildings. The impact when combined, can be significant.

Taking these in turn, distributed generation refers to the creation of electricity at or near where it will be used (such as solar panels on buildings), the connection to a distribution network and even local forms of energy storage. The key difference from large renewable generation projects is that the production of energy and the consumption are in proximity and therefore the need to use transmission networks is reduced.

Over time, it is expected that this type of generation will increase as a proportion of the total capacity of energy supply in many markets around the world. According to Bloomberg New Energy Finance, Australia is likely to have decentralized as much as 45% of total energy capacity by 2040 with Japan and Germany at around 30%, for example4.

There are various benefits for the owner of a distributed energy system beyond those to the power grid. For example, energy production closer to the point of use can create cost savings given the optimized cost of rooftop PV. There are also broader benefits if excess solar is being created by a property, as this can be stored or sold onto someone else locally and thereby reduce demand on the grid. It is also possible to create virtual power plants by pulling together smaller energy assets, creating one larger aggregated system that can then undertake grid balancing services.

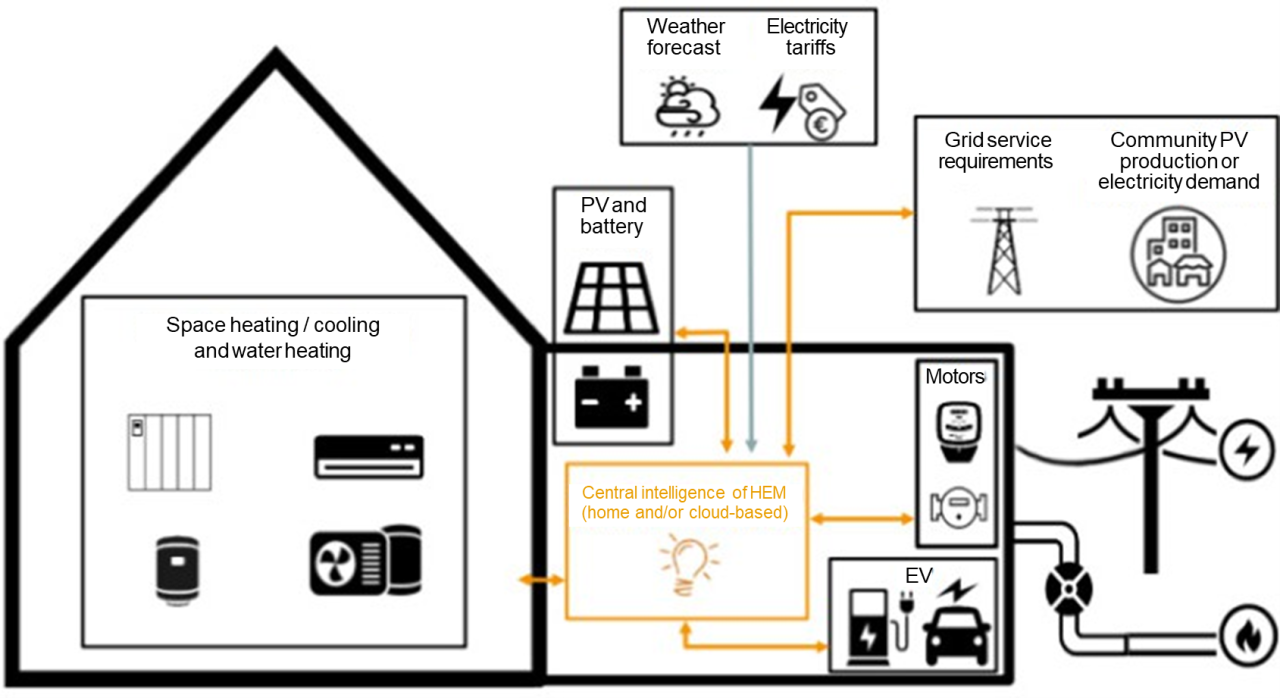

Technology and the use of digital systems in buildings further drives efficiencies from the energy created. Smart meters, the internet of things, sensors, AI forecasting and advances in battery storage, collectively controlled by Energy Management Systems (EMS) (referred to as HEMS when used in the home), can optimize the energy created and used.

There are also new technologies and systems to enhance the way we heat buildings which are less resource intensive than traditional methods like gas boilers. There are various alternatives including electrification, green gas (including hydrogen), and district heating.

In the UK, for example, the government announced that all newly built homes will need to adhere to the Future Homes Standard, expected to come into effect in 2025. This mandates that only energy-efficient heating systems can be installed in new homes built after 2025, encouraging housebuilders to look for alternative heating options to gas boilers5.

We believe that electrified heating will be the critical technology to replace gas boilers in the UK, in part because the electricity grid infrastructure already exists and it aligns with the UK’s renewable generation plans. There are three viable technologies to electrify heating in the home: electric heating, heat pumps and infrared heating systems.

When applied alongside HEMS and integrated with distributed generation technologies, significant efficiencies can be created – below is an example of this interplay.

Source: LCP Delta

This home generates some of its own energy from solar PV panels. The clean energy is deployed into its electrically powered infrared heating system, and also charges their battery storage system and electric vehicle. These processes are optimised by its sophisticated home energy management system. The homeowner is also able to sell any excess electricity when it is more expensive. We expect to see this type of installation within new build properties.

3. How do you approach the selection of investment opportunities in this sector?

For us, it’s essential that any investment opportunity is carefully filtered through fundamental infrastructure principles.

Our view is that true and attractive infrastructure opportunities should sit within what we call a ‘build-to- core’ approach. This means that we build rather than acquire assets in sectors with high barriers to entry, these assets should play a critical role in their context, and they should have strong green credentials given the over-riding decarbonisation theme.

We also need to be selective about the strategies that we pursue given the significant scope for disruption and the number of entities targeting this sector. For example, when looking at the distributed energy generation supply chain, there are equipment manufacturers, installers, financiers, and energy suppliers all seeking opportunities.

This competition creates a menu of strategies from which to gain sector exposure, but this requires a deep understanding of the sector dynamics.

We are exploring a range of areas, from property and products to service and revenue models; however, we are keenly focused on business models that create recurring revenues. We also believe that the right partnerships with utilities, homebuilders and equipment suppliers will be key to unlocking the opportunities in this space.

There is going to be disruption and multiple different approaches taken across the sector over the coming years. Successful investors will be those that keep to fundamental infrastructure principles, select businesses anchored with models that create recurring revenues and establish relationships with the right partners.

To discuss any of the themes covered in this latest InfraRed insight, please send an email to info@ircp.com and one of the team will be in contact.

Risk and other considerations

This material is being provided for informational purposes only. The author’s assessments do not constitute investment research and the views expressed are not intended to be and should not be relied upon as investment advice. This document and the statements contained herein do not constitute an invitation, recommendation, solicitation or offer to subscribe for, sell or purchase any securities, investments, products, or services. The opinions are based on market conditions as of the date of writing and are subject to change without notice. Certain charts, graphs and other information have been obtained from sources we believe to be reliable, but we do not warrant or guarantee the information’s completeness or accuracy. No obligation is undertaken to update any information, data or material contained herein. It is important to note that all investments are subject to risks that affect their performance in different market cycles and the reader should not assume that all references to investments or sectors identified and discussed were or will be profitable. There is no guarantee that any forecasts made will come to pass. This document may contain forward looking statements that is, statements related to future, not past, events or other matters – including, without limitation, statements regarding our intent, belief, or current expectations with respect to InfraRed’s business and operations, market conditions, results of operation and financial condition, capital adequacy, provisions for impairment and risk management practices. Due to various risks and uncertainties, actual events, results, or performance may differ materially from those reflected or contemplated. Investment in infrastructure assets involves several business risks. Revenues can be affected by a number of factors, including economic conditions, political events, competition, regulation and the financial position and business strategy. In addition, operating costs can be influenced by a wide range of factors including the breakdown or failure of equipment or processes, labor disputes, industrial accidents, compliance requirements and unanticipated changes in the availability or price of the various elements necessary for the operation of an infrastructure asset. Investments in private equity funds are speculative and involve a higher degree of risk than more traditional investments. Investments in private equity funds are intended for sophisticated investors only and can be illiquid due to restrictions on transfer and lack of a secondary trading market. They can be highly leveraged, speculative and volatile, and an investor could lose all or a substantial amount of an investment.

2 Emissions from the residential sector do not include emissions from the generation of electricity consumed, as these emissions are included in the energy supply sector

4 https://about.bnef.com/blog/henbest-energy-2040-faster-shift-clean-dynamic-distributed/

5 https://www.gov.uk/government/consultations/the-future-homes-and-buildings-standards-2023-consultation