Our view is that the journey toward lower emissions is complex and will likely take longer than expected. It goes beyond allocating to renewables; it involves scaling up and transforming most of our infrastructure and requires a new perspective on strategy from investors.

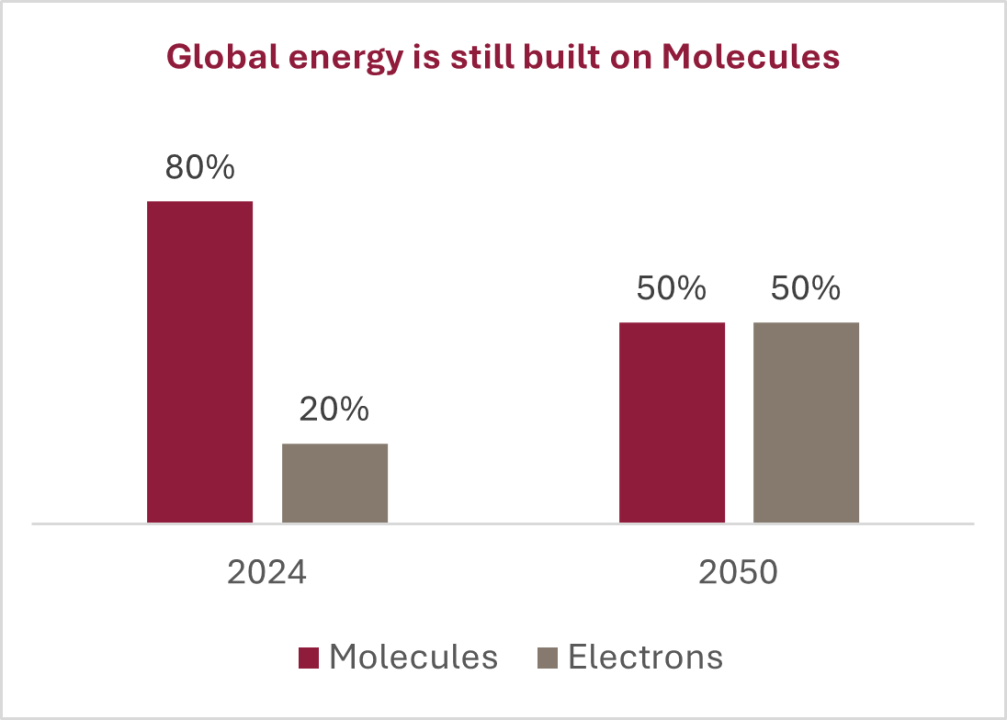

Left chart source: InfraRed Capital Partners. Energy Institute, Statistical Review of World Energy 2024. Molecules: oil, coal, natural gas. Electrons: nuclear, hydro and other renewables.

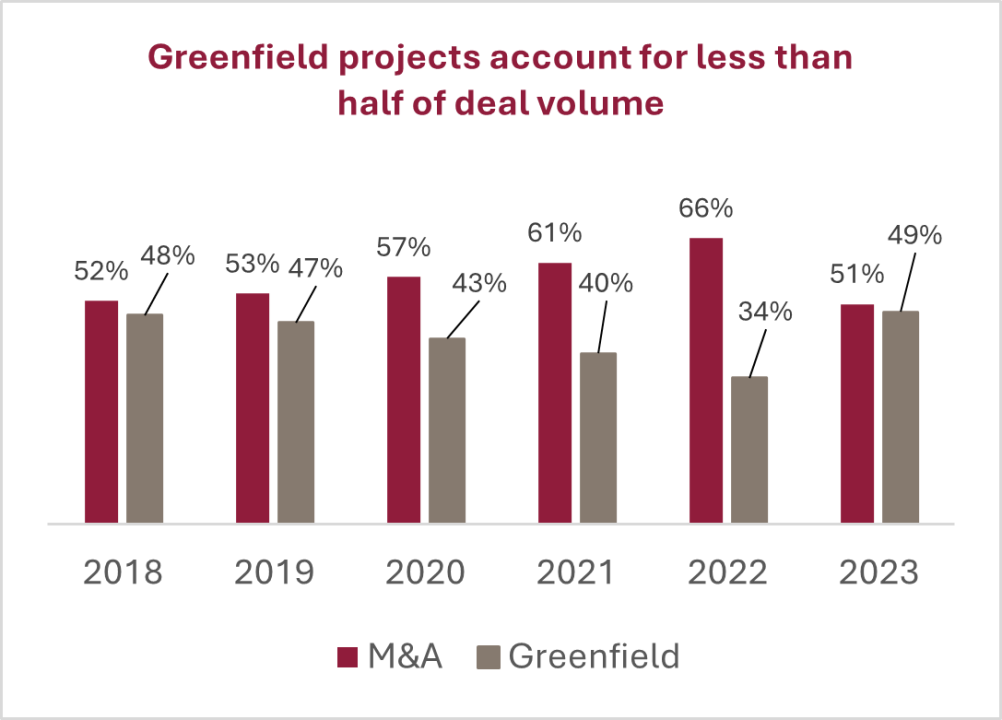

Right chart source: Infralogic, June 2024. Percentage calculated on deal volume in USD, including transactions that reached financial close globally.

An addition

The term ‘energy transition’ may imply a straightforward swap from fossil fuels to renewables. However, it is not that simple. Energy demand continues to grow, and hydrocarbons still make up around 80% of global energy. The energy transition is not only about adding renewables to the mix, it is multidimensional, unfolds at a different speed across countries and sectors, and requires a balance between economic growth, sustainability and energy security. It encompasses a broader scale-up across multiple sectors including energy, transport, utilities and digital infrastructure, and it redefines the risk profile of infrastructure sectors, requiring a more meticulous perspective on portfolio construction.

The Energy Addition is about deploying capital to acquire, expand and aggregate existing infrastructure assets to match the growing demand of a rapidly developing world and transform them to fit the paradigm of decarbonisation. As the addition unfolds over a long period of time, it also means that some core infrastructure assets are expected to continue providing an essential service to society for the long-term, and will require capital to adapt. Expansionary capital is at the core of a broadening opportunity set for investors.

Energy demand grows

Global energy demand will continue to expand at an annual rate above 3% [1], with population increase and industrialisation pushing up fossil fuel consumption in growing economies. New technologies, such as AI, will further accelerate global power demand. Data centres consume c. 3% of global power but may reach 8% by 2030 [2].

Historically, every energy transition, has been an energy addition. The world consumes about three times the amount of coal it did in the 1960s. Energy additions unfold over a very long time. For example, oil was discovered in 1859, but overtook coal as the world’s primary energy source only in the 1960s [3]. In comparison to other transitions, policy and regulation today are catalysts of decarbonisation; the objective is to transform the energy foundations of an $88 trillion global economy in slightly longer than a quarter century [4].

Electrification accelerates

The good news is that the Energy Addition is already happening, and electrification is an accelerating trend. In 2022, 295GW of new renewable capacity was added globally. By 2030, about 70% of new generation capacity is expected to be renewables, with over $5 trillion expected to be invested in renewable power and storage [5]. Renewables and battery storage will continue to be meaningful and contribute to electrifying our economies across different sectors, including transport, such as EV charging. A shift to a mineral-based economy, from a fuel based one, will spur unprecedented demand for critical minerals, such as lithium, nickel and cobalt requiring a meaningful expansion of waste recycling infrastructure in Europe and North America, to enable the collection and reintegration of materials, such as with battery components.

Testing investors’ convictions

Electrification could make up 50% of the global energy system by 2050 [6], requiring an upgrade of existing assets such as power grids. While large-cap network utilities were a source of long-term returns, financing the transition also means increased business risk, more capital expenditure and testing the resilience of regulation. The Energy Addition may change perspectives on the risk/return proposition of existing infrastructure sectors.

Decarbonising molecules

A key challenge. Most new thermal capacity will be added across energy-hungry developing economies. ESG policies limit capital deployment in thermal generation for most institutional investors. Yet, the opportunity set in the energy sector is significant. It means scaling up infrastructure capacity where the economics make sense today, such as with electrification or biofuels. In the future, with innovation reducing costs, it may mean creating new infrastructure for carbon capture utilisation and storage (CCUS), e-fuels or green hydrogen.

Strategy evolves

The Energy Addition represents a multi-sectoral expansion of the investment opportunity set for private infrastructure investors. The market highlights three key differences compared to the past decade which investors may want to consider in their strategic allocation to infrastructure:

- Middle-market: The median deal size is reducing and moving towards the middle-market [7]. Allocating to this segment will help investors capture market beta.

- Return enhancement: The role of infrastructure is expanding beyond diversification to a source of return enhancement, particularly amid higher interest rates. Private investors can source these across the risk spectrum, in traditional core sectors, core-plus, and value-added strategies leveraging expansionary capital to grow critical infrastructure.

- Capital rotation and diversification: The Energy Addition can reshape the risk-return profile of infrastructure sectors. With demand and supply of infrastructure assets growing, actively rotating capital into assets with expansion potential and a clear outlook, may support out performance. A growing mid-market also means the opportunity set is expanding higher up in the risk/return spectrum, with broader manager selection and portfolio diversification playing a key role for performance resilience.

For further information or to speak to a member of the team, please fill out the form here.

Gianluca Minella

Head of Infrastructure Research

References:

[1] Bloomberg New Energy Finance, 2024

[2] Bloomberg, June 2024

[3] S&P Global, 2023

[4] International Monetary Fund, April 2024

[5] S&P Global, 2023

[6] World Economic Forum, 2024

[7] The middle-market includes unlisted infrastructure companies with an enterprise value of $500 million to $2 billion

[8] $13bn+ equity under management (USD) – Uses 5-year average FX as at 31st December 2023 at GBP/USD of 1.2881, EUR/USD of 1.1226, EUM is USD 13.433m.