The 2024 U.S. presidential election has ushered in a new Republican administration, raising questions about the future of renewable energy subsidies under the Inflation Reduction Act (IRA). While President-elect Trump has suggested revisiting unspent IRA funds, we believe the economic and political realities make significant retroactive changes to renewables’ subsidies unlikely.

Subsidy Stability and Growth Potential

The U.S. renewables sector has already transformed dramatically, supported by decreasing technology costs. Moreover, the IRA’s incentives for renewables, including tax credits for solar, wind, and energy storage, have catalysed a surge in clean energy development. According to Bloomberg New Energy Finance, in 2024, the U.S. added 56GW of solar, wind & storage capacity, while the pipeline includes 1,100 GW of additional capacity over the next ten years.

The IRA has yielded bipartisan benefits, with much of the new private investments in green technology concentrated in Republican-led states. While renewables appear in a safe spot, the IRA’s credits for electric vehicles (EVs) and charging infrastructure are costing about $180 billion over the next decade and may be subject to some policy changes.

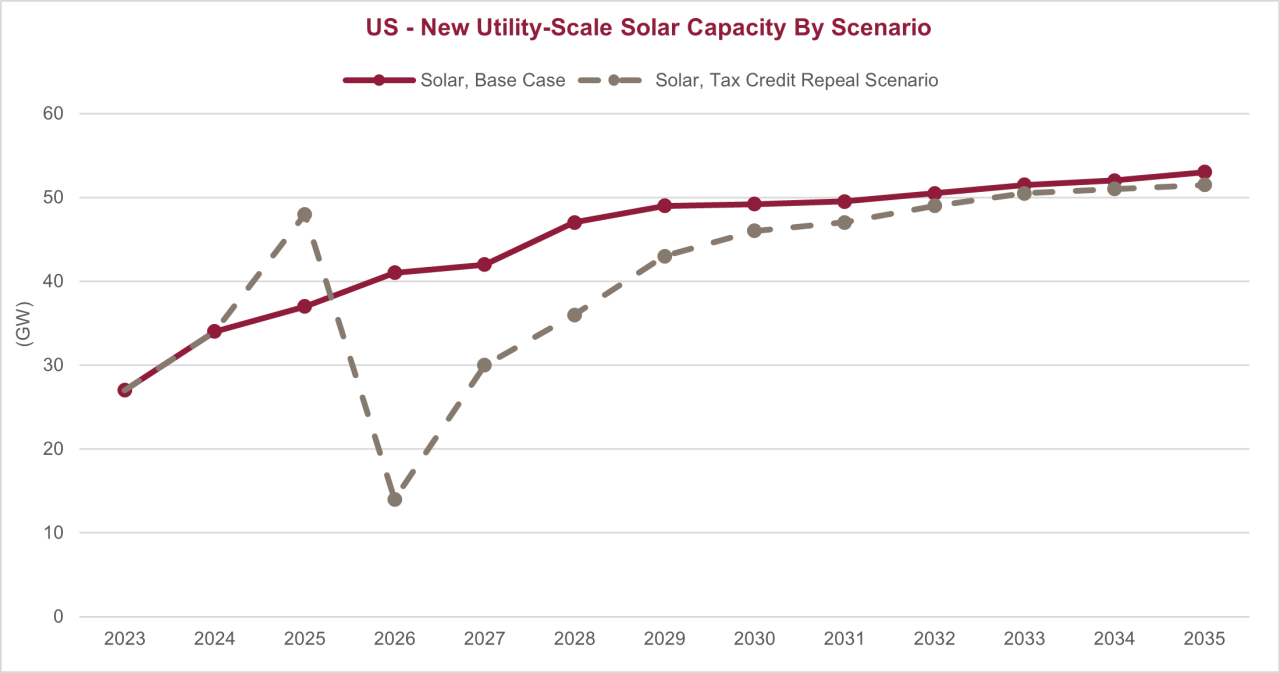

Given the complexity of revoking these credits retroactively, combined with strong congressional support across party lines, we expect stability for current and near-future renewable projects. While a repeal of IRA renewables’ subsidies is unlikely, under a theoretical tax credit repeal scenario, there would likely be an acceleration of projects initially planned for 2026 / 2027, to 2025, while the structural advantages of renewables—such as declining costs and market competitiveness— would support continued capacity growth regardless of policy shifts, as described for the case of new utility-scale solar capacity in the chart below.

Source: BloombergNEF, November 2024. Data include aggregation of: Buffer, Alaska, New York, Southeast, Northwest, New England, Hawaii, SPP, MISO, PJM, Southwest, Texas, California. For illustrative purposes only. Past performance is not a guide for future returns. There is no guarantee that forecast highlighted will materialise.

Economic Fundamentals Favour Renewables

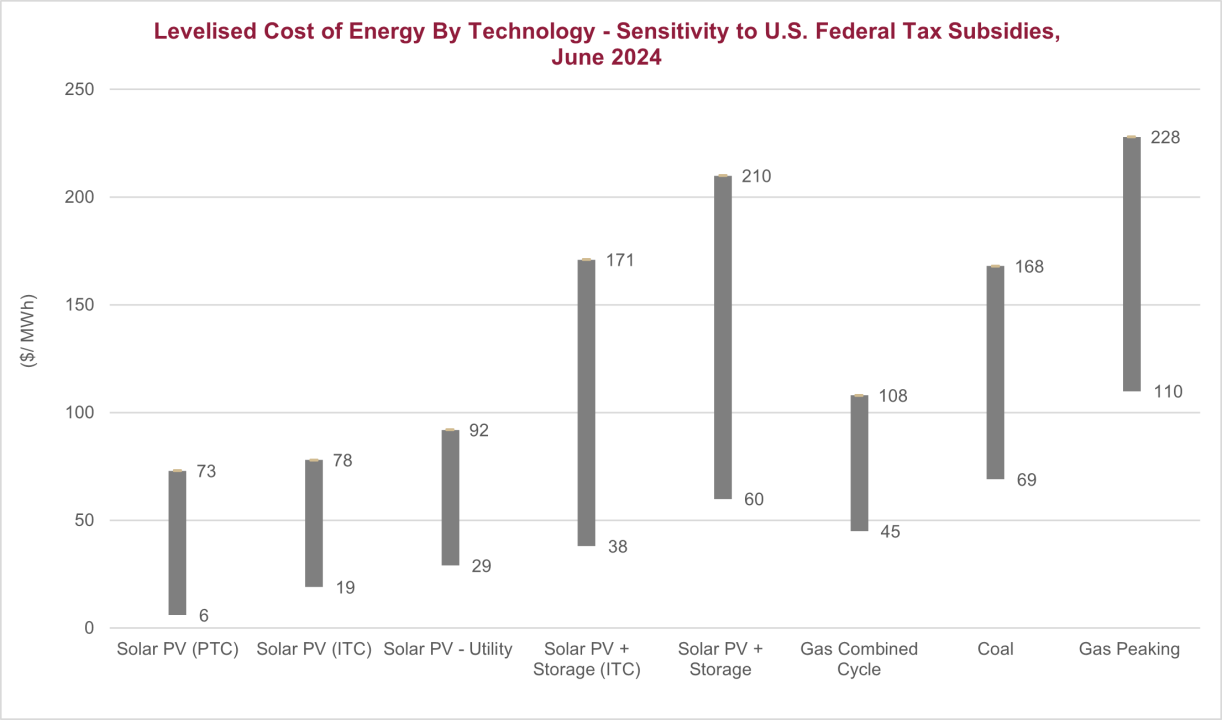

Renewables are now the cheapest source of new electricity in the U.S., outperforming new natural gas capacity in many regions from a Levelised Cost of Energy (LCOE) perspective, despite the comparatively low cost of U.S. gas compared to other global regions, as described for the case of new utility-scale solar capacity in the chart below. The sector’s competitiveness is bolstered by significant capital inflows, driving economies of scale and innovation. Even without subsidies, renewables’ cost-effectiveness positions them for sustained expansion in the medium to long-term.[1] While the introduction of import tariffs on Chinese manufacturers may drive project cost increases, we believe that a strong USD shall partially compensate for rising import costs over the medium-term.[2]

Source: InfraRed Capital Partners, Lazard levelised cost of energy version 17.0, June 2024. For illustrative purposes only. Past performance is not a guide for future returns. There is no guarantee that the forecast highlighted will materialise.

Rising Power Demand and Capital Needs

U.S. electricity demand is expected to soar, driven by electrification trends, boosting power demand in sectors such as EV charging, and heating. Moreover, the recent, anticipated expansion of data centre capacity underscores the need for more renewables generation capacity to meet demand sustainably. In certain U.S. states, the structural increase in power demand from the digital sector may lead to additional market changes favourable to renewables. For example, in Texas, Ercot[3] demand response prices may increasingly depend on Bitcoin mining flexibility, with higher breakeven prices providing material support to the business case for new energy storage capacity, to increase power system flexibility.[4]

We see a meaningful mismatch between the available capital and the investment required, creating opportunities for infrastructure investors to step in and fill the gap. According to S&P Global, incremental U.S. power demand from data centres could be 150-250 terawatt hours (TWh) between 2024 and 2030, requiring about 50 gigawatts (GW) of new generation capacity through 2030, necessitating about $60 billion of investment in generation, and $15 billion in transmission, with grid infrastructure representing the biggest hurdle to power supply growth.[5]

Power Purchase Agreements and Pricing Trends

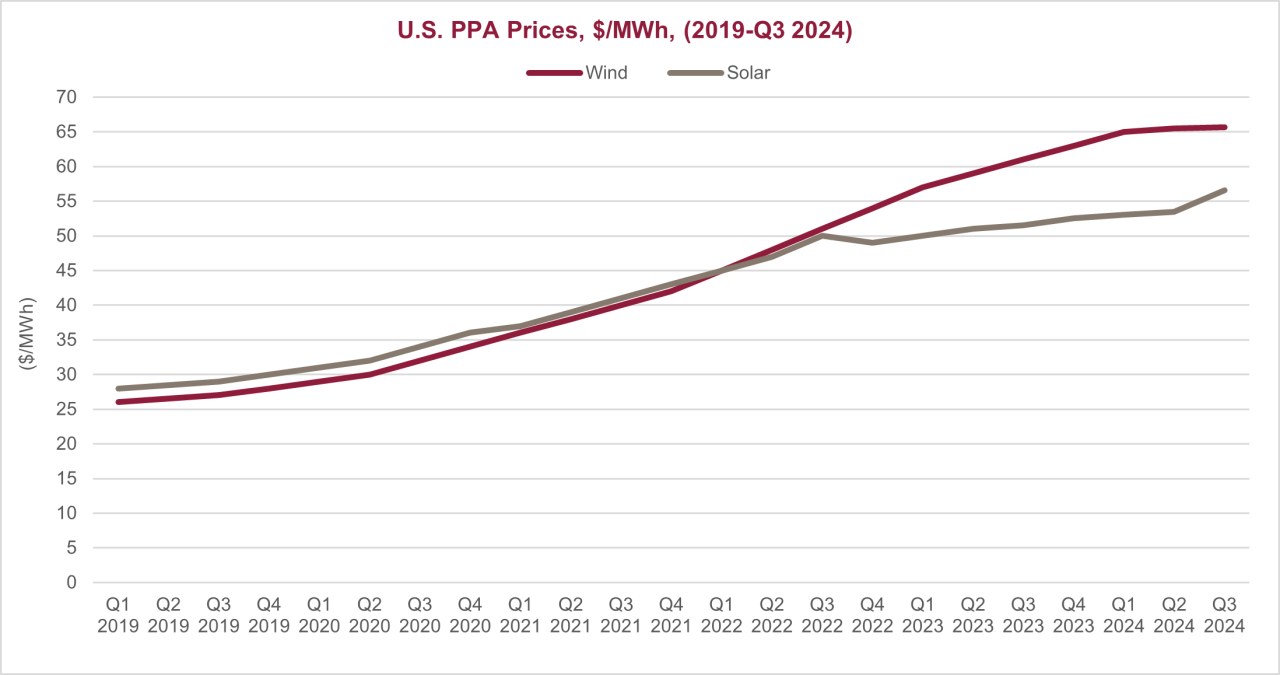

Tight power market capacity may be a key driver to higher power prices. Therefore, Power Purchase Agreements (PPAs) for renewables have been climbing, reflecting both the growing value of renewable energy and the need for stable, long-term energy solutions, as the largest corporations in the U.S. increasingly focus on incorporating clean energy targets in their business plans. This trend underpins the resilience and profitability of renewable investments even in a shifting political landscape.

Source: InfraRed Capital Partners, Scotiabank US Renewables Market Update, August 2024. For illustrative purposes only. Past performance is not a guide for future returns. There is no guarantee that forecast highlighted will materialise.

Positioning for the Future

While policy uncertainties may remain, the U.S. renewable energy sector is set to thrive, in our view. Investors should focus on opportunities in high-demand markets, leveraging the twin trends of decarbonisation and digitalisation. The renewable energy story in the U.S. is no longer solely about policy—it’s about economics, demand, and the inevitable transition to cleaner energy sources.

To sign up for our insights series, or to speak to a member of the team, please fill out the form here.

Gianluca Minella

Head of Research

Priyanka Kandula

Managing Director

References:

[1] Lazard, Roland Berger, Levelized Cost of Energy By Technology, June 2024

[2] Macrobond, November 2024

[3] Electric Reliability Council of Texas

[4] BloombergNEF, August 2024

[5] S&P Global, Data Centers: Surging Demand Will Benefit And Test The U.S. Power Sector, 22 October 2024

InfraRed has based this document on information obtained from sources it believes to be reliable, but which have not been independently verified. All charts and graphs are from publicly available sources or proprietary data. Except in the case of fraudulent misrepresentation, InfraRed makes no representation or warranty (express or implied) of any nature or accepts any responsibility or liability of any kind for the accuracy or sufficiency of any information, statement, assumption or projection in this document, or for any loss or damage (whether direct, indirect, consequential or other) arising out of reliance upon this document. InfraRed is under no obligation to keep current the information contained in this document.

You are solely responsible for making your own independent appraisal of and investigations into the products, investments and transactions referred to in this document and you should not rely on any information in this document as constituting investment advice. This document is not intended to provide and should not be relied upon for tax, legal or accounting advice, investment recommendations or other evaluation. Prospective investors should consult their tax, legal, accounting or other advisors. Prospective investors should not rely upon this document in making any investment decision.

Investments can fluctuate in value, and value and income may fall against an investor’s interests. The levels and bases of taxation can change. Changes in rates of exchange and rates of interest may have an adverse effect on the value or income of the investment or any potential returns. Figures included in this document may relate to past performance. Past performance refers to the past is not a reliable indicator of future results. There can be no assurance that the opportunity will achieve its target returns or that investors will receive a return from their capital. Investment in the products or investments referred to in this document entails a high degree of risk and is suitable only for sophisticated investors who fully understand and are capable of bearing the risks of such an investment, including the risk of total loss of capital originally invested. It may also be difficult to obtain reliable information about the value of these investments, which will often have an inherent lack of liquidity and will not be readily realisable.

This document is being issued for the purposes of providing general information about InfraRed’s services and/or specific assets and their operational performance only and does not relate to the marketing of investments in any alternative investment fund managed by InfraRed.

InfraRed may offer co-investment opportunities to limited partners, or third parties. These circumstances represent conflicts of interests. InfraRed have internal arrangements designed to identify and to manage potential conflicts of interest.

This document should be distributed and read in its entirety. This document remains the property of InfraRed and on request must be returned and any copies destroyed. Distribution of this document or information in this document, to any person other than an original recipient (or to such recipient’s advisors) is prohibited. Reproduction of this document, in whole or in part, or disclosure of any of its contents, without prior consent of InfraRed or an associate, is prohibited.

This document is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation.

InfraRed Capital Partners is a part of SLC Management which is the institutional alternatives and traditional asset management business of Sun Life.