Outlook

Shifting long-term thematics support the case for infrastructure investment

Characteristic resilience in times of volatility

Looking at the infrastructure asset class, either in the context of the past year or for the outlook ahead, might be best done through two distinct lenses. Both the near- and long-term perspectives offer their own set of insights into the potential risks, opportunities and challenges ahead for infrastructure investors.

In the near term, throughout 2023 we saw a continuation of several macroeconomic themes that have been playing out over the course of the year: higher inflation, elevated interest rates and the resultant market volatility. Infrastructure assets are historically more resilient to these factors than other types of alternative investments, and infrastructure’s performance during bouts of pressure in 2023 were consistent with this characterization.

It is important at this point to be reminded of the characteristics of infrastructure investments that help them maintain their resilience amid uncertainty. We expect that high-quality infrastructure investments may be more insulated from the broader economy and policy landscape given both their long-term and conservative debt structures, which are generally less sensitive to rate fluctuations, and often contracted revenues, that may be correlated to inflation.

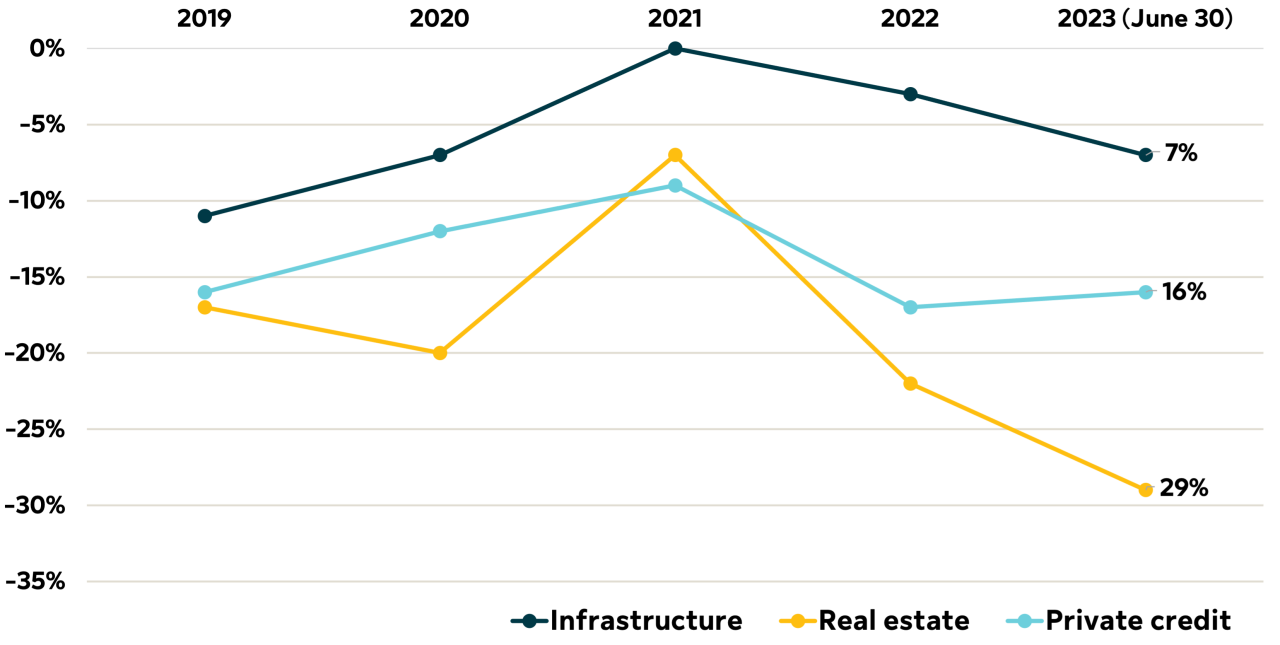

The following graph shows that the discount to net asset value (NAV) in the private secondary market for infrastructure held up better in the volatile first half of 2023 compared to other alternative asset classes.

Infrastructure holding up well during volatility

Discounts to NAV in the secondary market

Source: Greenhill Secondary Market Review, H1 2023. Market data based on Greenhill transactions and other known transactions are reported in the source. For more information, visit www.greenhill.com.

Macro concerns could lessen, but likely to remain

We have seen some stabilization in the macroeconomic environment, though we also caution that some risk factors remain, such as further escalations in geopolitical conflicts. Moreover, market volatility and underlying inflation and rate uncertainty could continue to affect asset pricing and investor demand in 2024.

With respect to inflation, our observations of market sentiment suggest some confidence that we are at, or perhaps even past, the point of peak rates. However, we also see evidence that even if inflation comes off its highs, it will likely remain sticky and range-bound for the near term.

An evolution in thematics

Shifting to the longer-term lens, while we believe the thematic megatrends that we have identified in previous discussions (such as decarbonization, digitalization and demographic changes) should continue to drive markets, 2023 saw some changing dynamics that could further shape infrastructure demand. The greater role of public policy within megatrends such as decarbonization – through initiatives like the Inflation Reduction Act in the U.S., the European Green Deal and the COP 28 agreement on transitioning away from the use of fossil fuels – had an increasing impact in the past year and into 2024.

These policies have created an environment of intensified competition between countries for infrastructure investment capital and expertise. Coupled with numerous geopolitical security concerns around the world, we are seeing evidence of a “deglobalization” effect around infrastructure investment. A growing number of distinct regions are seeking to attract more of what may be a finite amount of available capital in a given thematic sector, for example, in opportunities arising from onshoring the supply chain in logistic facilities, intermodal transportation and other operational enhancements. This represents a considerable tilting of the demand–supply balance, and we expect such developments to serve as a medium to long-term positive driver of infrastructure investment.

For further information or to speak to a member of the team, please fill out the form here.

Authored by:

Jack Paris, Chief Executive Officer

Richard Crawford, Head of Energy Income Funds

Edward Hunt, Head of Core Income Funds

Stephane Kofman, Head of Capital Gain Funds