Infrastructure investors face a new market reality in 2025, as a result of several recent structural shifts to the investment environment, including a higher-for-longer interest rate environment and a new US administration.

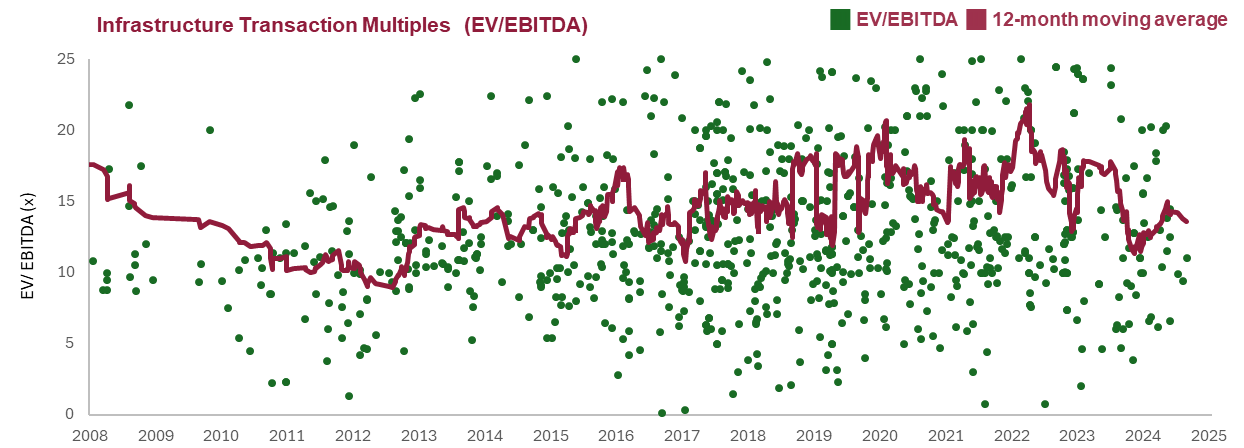

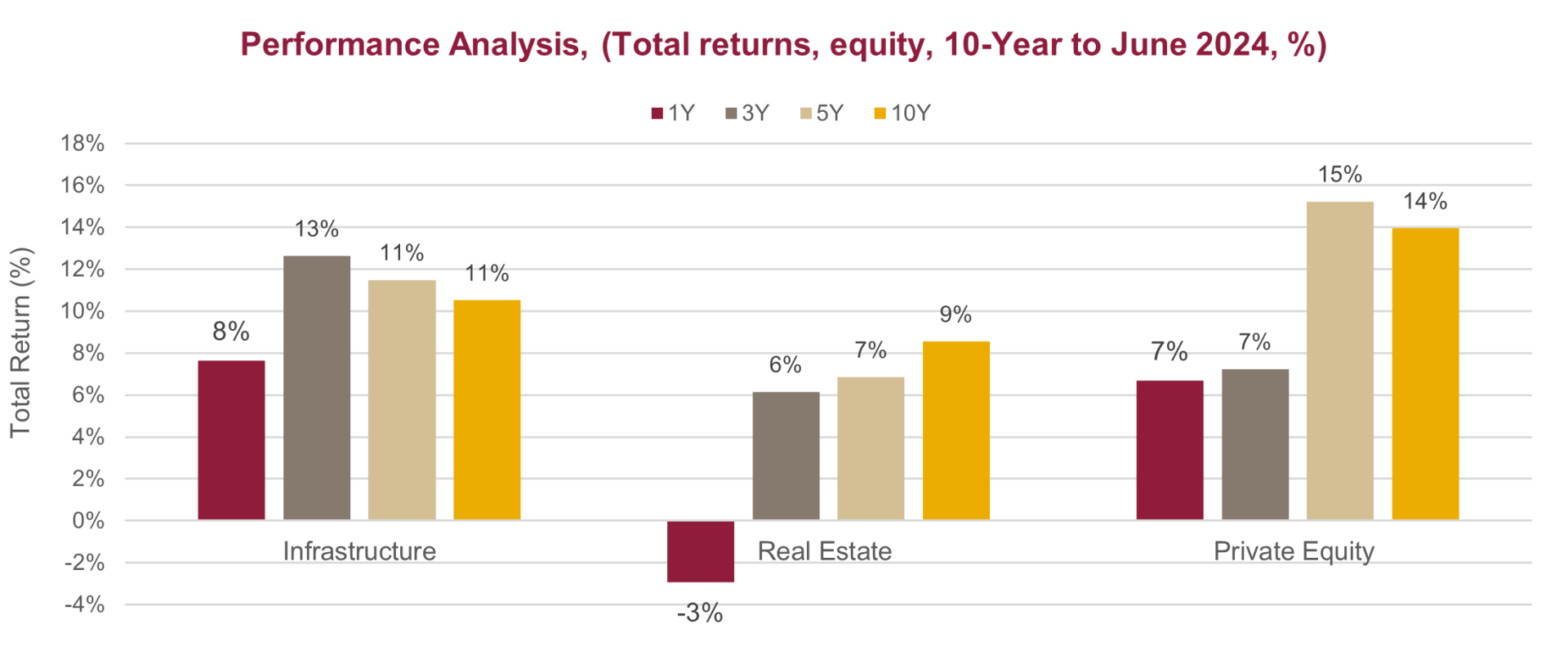

US equity markets continue to appear bullish and long-term bond yields have not been as attractive over the past 15 years as they are today. With infrastructure valuations having largely stabilised, and entry returns having widened, core infrastructure is becoming increasingly attractive on a relative basis, with upside potential should interest rates decrease.

Moreover, looming large on the horizon is an anticipated multi-decade infrastructure investment super-cycle underpinned by the investment opportunities in decarbonisation and digitalisation, which offers potential for enhancing infrastructure returns through value-add strategies.

The fundamental strengths of the asset class are not expected to change, including its performance resilience to economic cycles and inflation protection.[1] The focus for investors is how to allocate to infrastructure effectively in today’s market environment, balancing income and growth opportunities.