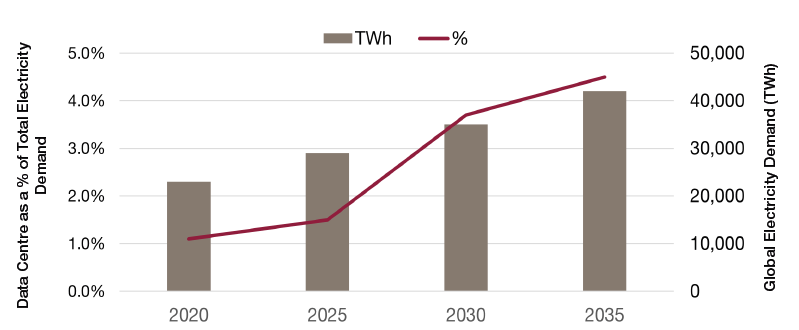

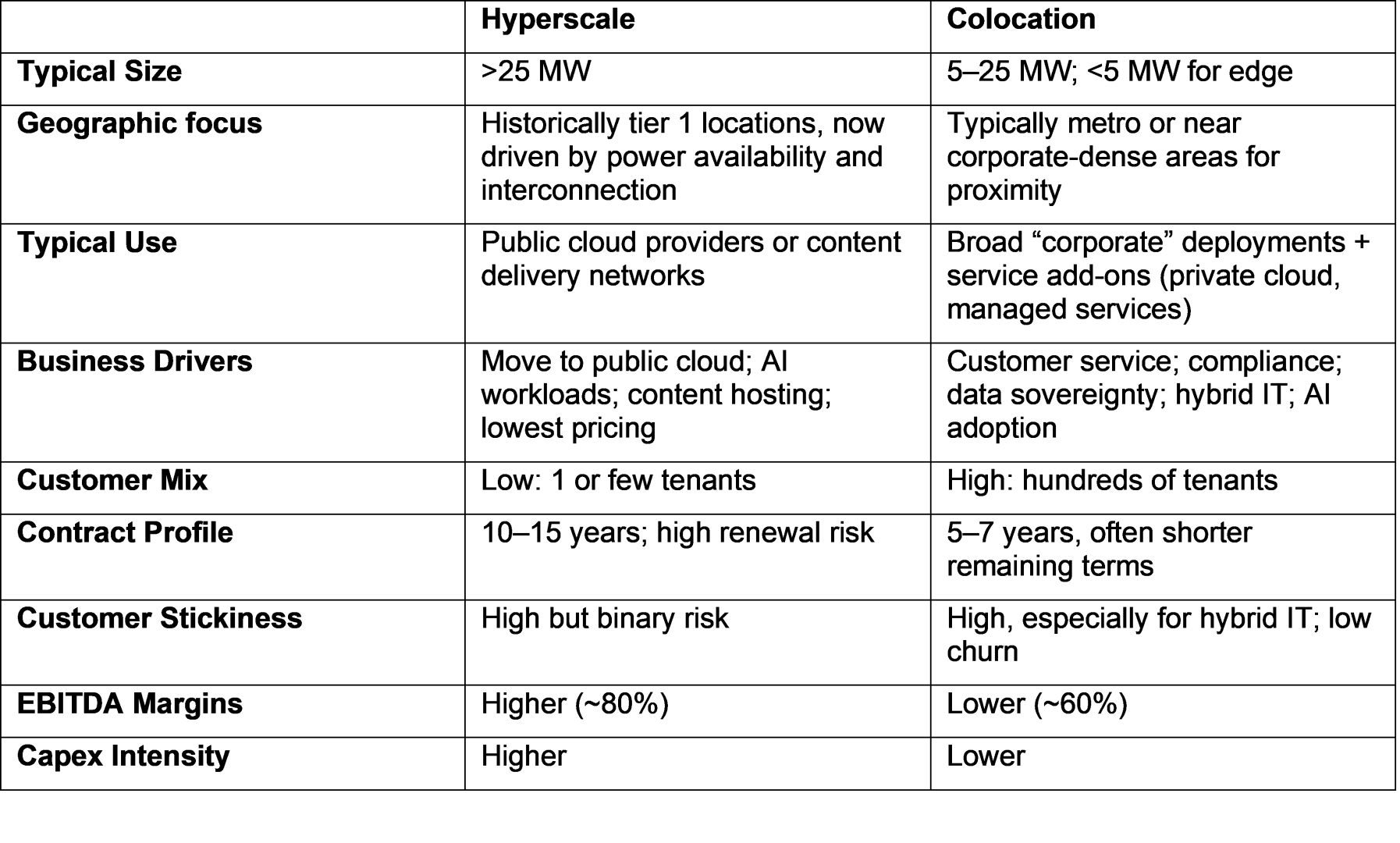

As data centres expand, investor questions multiply: In 2024, data centre investment reached record highs, driven by AI workloads and ongoing digitalisation trends—such as cloud computing and data sovereignty—which are boosting demand for new capacity. For 2025, projections indicate that transaction volumes may exceed USD 120 billion.1 As investors’ portfolio exposure to data centres grows, more questions are emerging about the sector. Increasingly, investors are focused on understanding the business drivers, interplay, and trade-offs between hyperscale and colocation data centre fundamentals.

The data shows that the future isn’t about choosing between hyperscale and colocation—it’s about leveraging both to build resilient, scalable digital infrastructure.

Global Data Centre Capacity Growth by Type (GW, 2020-2035)

Source: IEA, Energy and AI Observatory, April 2025. Past performance is not a guarantee for future returns. There is no guarantee that the forecast highlighted will materialise. Notes: Colocation data centers host multiple tenants—including enterprises. Enterprise data centres are owned by a single organisation to run IT systems and store data.

Why both are essential: According to the latest IEA forecast, both hyperscale and colocation data centres are indispensable to the digital ecosystem. While current attention is largely focused on hyperscalers—driven by AI demand—projections indicate that colocation growth may outpace hyperscale by 2035.2

Hyperscale data centres deliver substantial scale and efficiency for cloud and AI giants, whereas colocation facilities offer flexibility, edge proximity, and neutrality for multiple companies and service providers. Together, they form the backbone of global connectivity and computing. Although forecasts may shift rapidly given the sector’s pace of change, one point remains clear: both business models are essential to global digital infrastructure, and neither can be overlooked.