In two explanatory videos below, InfraRed’s Edward Hunt, Head of Core Income Funds, and Helen Price, CFO, provide an overview of how infrastructure can provide protection from inflation and how this works in practice across a range of infrastructure asset types.

Over the past year, UK inflation has hit levels not seen since the 1970s. Although it has fallen back from its high point in October 2022, it is forecast to remain well above the government’s 2% target until the first half of 2025, at the earliest. This has had far-reaching consequences across business but also a corrosive impact on investments and savings.

For example, if you had invested £10,000 in a UK 10-year government bond (Gilt) with a 2.6% return in 2013, the real return on your investment would have been negative as the average inflation over the last 10 years was 4.1%. Over a 10-year period, this would equate to £1,137 in real terms and your real return would be -1.4% in terms of purchasing power.

This effect on investments is particularly detrimental when inflation runs far above expectations for a protracted period, such as the environment we find ourselves in today.

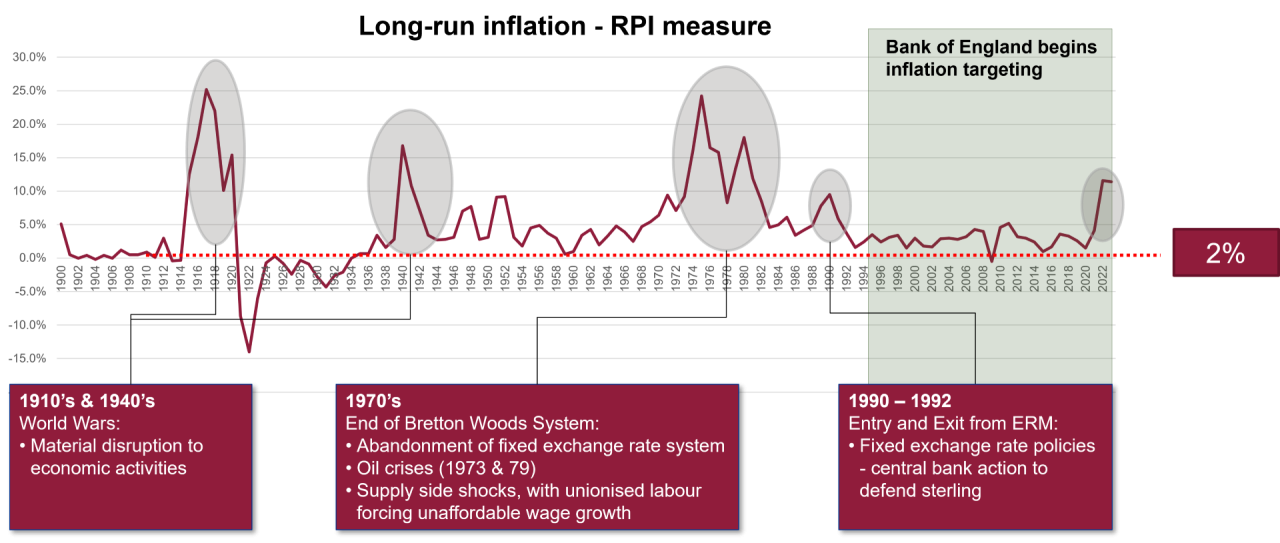

In the UK, inflation has averaged about 2% over the last 100 years or so, as shown in the graph below. The very significant spikes in inflation you can see were caused by unique events – notably the two World Wars, the oil price crisis of the 1970’s and the UK’s exit from the ERM in the early 1990s. These spikes can be so severe, that they can wipe out vast amounts of wealth. For example, during the 70s, if you had invested in a UK 10-year government bond from 1970 to 1980, the value of your investment would have been eroded by 72%.