Rotating portfolios with market trends and aligning them to newer sectors, such as digital infrastructure is logical, but investors shouldn’t overlook the long-term role of transportation.

Insights

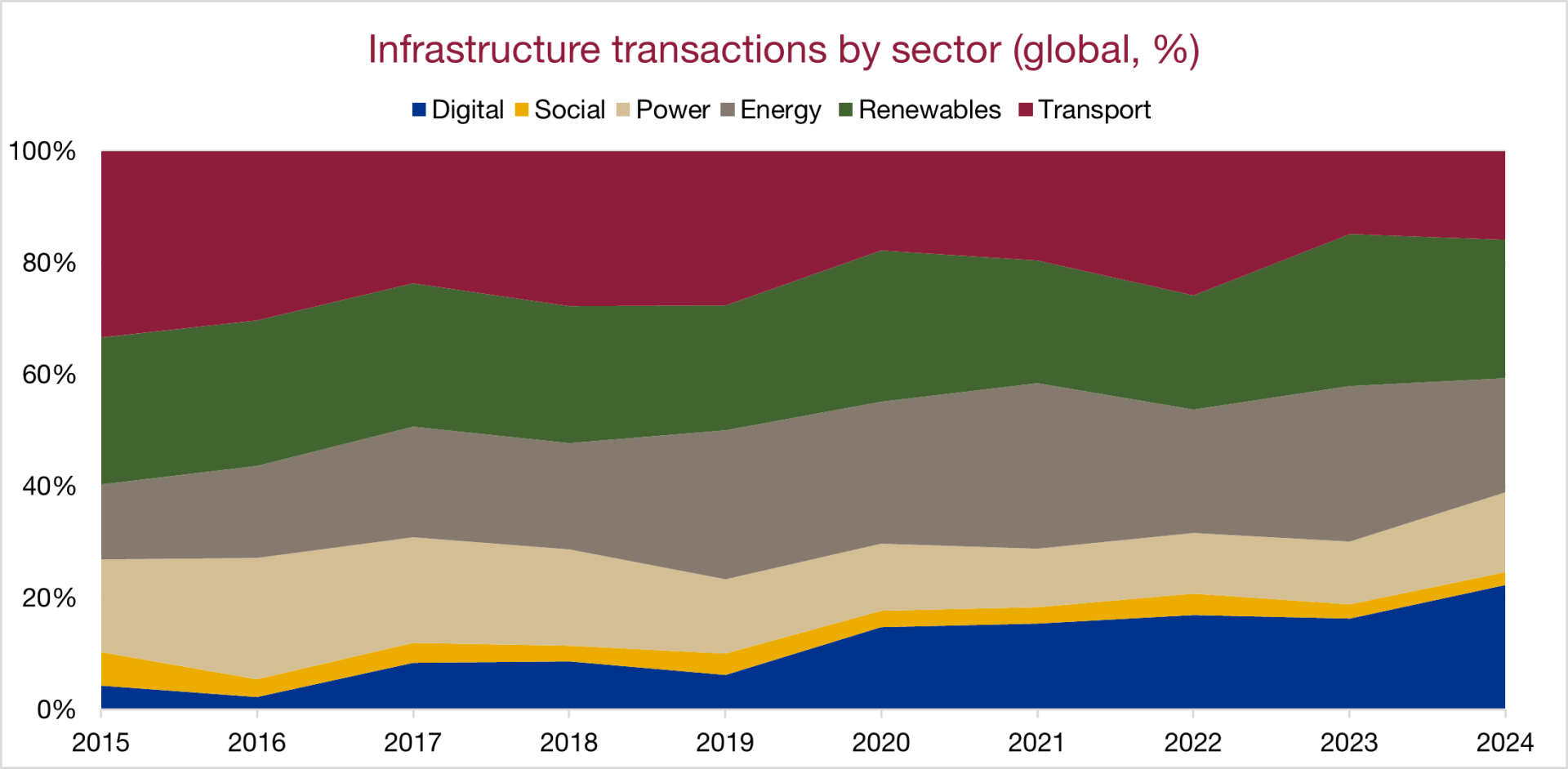

Transport’s declining deal share:

In recent years, there has been a clear shift in deal activity towards energy and digital infrastructure. These sectors have experienced significant transaction activity, driven by the secular tailwinds of the energy transition and digitalisation. We believe they represent compelling opportunities, but this focus has inadvertently led to a relative reduction in deal volumes for transportation.

Historically, transport accounted for approximately 30% of closed transactions; however, as at the end of 2024, transportation represents around 15% of deal volume, with the sector expected to maintain a similar share in the future [1].This trend is further influenced by the fact that long-term investors are often cautious about rotating out of quality transport assets, such as airports, ports and roads, as their portfolio exposure may not be easily replicable.

Source: Infralogic, as at December 2024. Includes transactions reaching financial close for the sectors mentioned in the chart, excluding sectors labelled as Environment, Commodities and Other. Past performance is not indicative of the future.

Transport’s legacy:

Transportation has historically been a cornerstone of investors’ portfolios. Over the past decade, transport infrastructure has significantly contributed to the resilient performance of infrastructure as an asset class, often accounting for a substantial portion of index weights [2]. Globally, sub-sectors such as toll roads, ports, rolling stock and airports are generally underpinned by mature and relatively homogeneous business and regulatory models, but their market availability has generally become scarcer in the market.

Most transport sub-sectors have a long and well-understood historical record of performance data across geographies, particularly when compared to newer infrastructure sectors, such as fibre, or EV charging, aligning them with the risk/return profile of core strategies. These factors enable investors to assess future demand patterns with relative precision, underpinning business plans and contributing to the optimisation of capital structures for additional value creation.

Source: Infralogic, as at December 2024. Includes transactions reaching financial close for the sectors mentioned in the chart, excluding sectors labelled as Environment, Commodities and Other. Past performance is not indicative of the future.

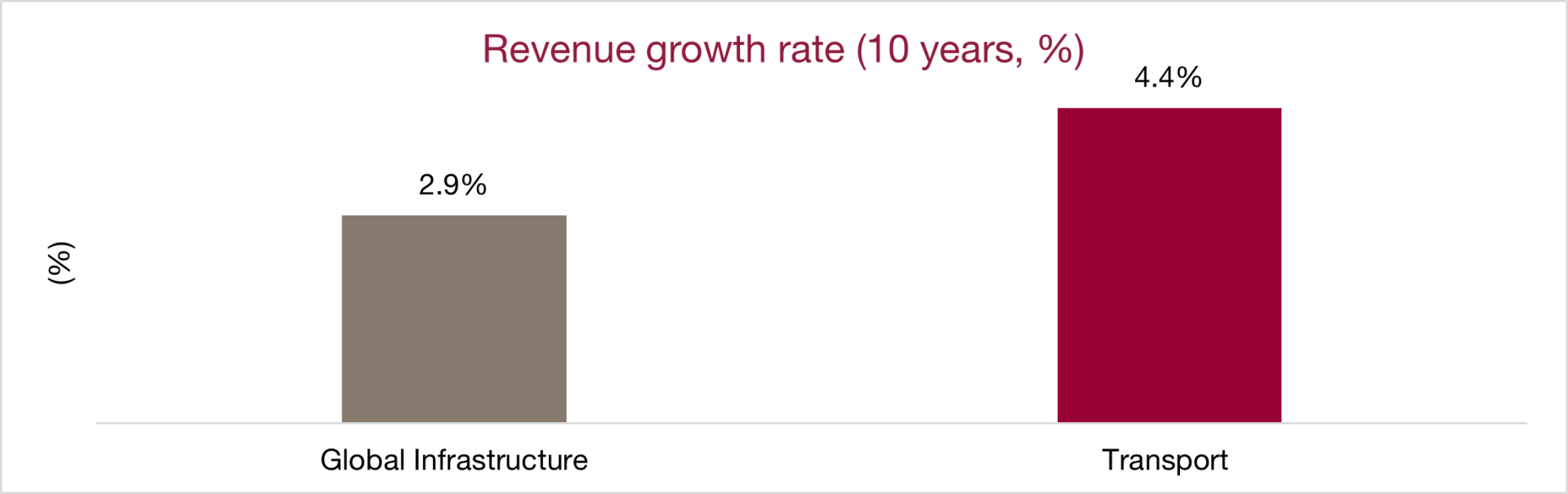

Income and growth engine:

Traditional transport sub-sectors, such as airports, roads or ports, offer an opportunity for regulated revenues, inflation recovery and some potential for growth, driven by an overall exposure to the macroeconomic environment. As a result, revenues have historically grown at 4.4%, above the 2.9% rate for broader global infrastructure [3]. Transportation assets have generally provided a combination of yield, and some capital appreciation, with the underlying demand growth and expansion capex often providing a base for capital appreciation.

Source: Macrobond, S&P Global, Dow Jones Brookfield, as at December 2024. Past performance is not indicative of the future.

Economic slow down and trade disruptions:

The transport sector is not exempt from various risks and disruptions, think about those experienced during the COVID-19 pandemic or uncertainties surrounding concession renewals, as recently seen in French toll roads. Different sub-sectors within transportation have varying macroeconomic exposures; for instance, rolling stock and toll roads may be more closely tied to domestic economic activity, while airports and ports are more dependent on global GDP. With heightened risks of economic slowdown and trade disruptions, the port sector might experience deceleration—particularly affecting North American ports that are vulnerable to tariff impacts. Since each transport asset is unique, investors can construct diversified transport portfolios that balance downside protection and upside potential from economic growth.

Looking ahead to the remainder 2025, tactically acquiring transport infrastructure could offer long-term investors—especially those focused on yield and mature assets—a chance to secure assets at attractive valuations. This is due to sector repricing influenced by rising interest rates combined with anticipated macroeconomic weaknesses and increasing trade barriers. While these factors pose risks, particularly for ports, they may also provide favourable entry prices for investors with a long-term perspective, in InfraRed’s view.

Source: Scientific Infra™ and Private Assets, used under permission data as at March 2025. Past performance is not indicative of the future. There is no guarantee that the forecast highlighted will materialize.

Secular tailwinds for growth:

Strategically, the transportation sector is on the cusp of transformative megatrends including a shift in global trade patterns, a reconfiguration in supply chains and decarbonisation — a factor that investors may want to consider in deal selection and from both a risk and return perspective. These trends can enhance the sector’s value proposition and offer avenues for long-term capital appreciation beyond what may currently be priced in traditional assets, particularly as transport electrification matures. At the same time, this can also offer investors an avenue for investment into newer and maturing sub-sectors, such as logistics, green transport leasing businesses, EV charging, biofuels, or sustainable aviation fuels.

Portfolio strategy:

In today’s environment of higher interest rates and persistent inflation, the recent under-allocation to transport deals may warrant reconsideration, with a growing number of investors likely displaying some under-allocation to the sector as their portfolios expanded across other sectors, based on market data [4]. Although transport deals have become scarcer in a market environment dominated by digital, energy, and renewables, their established track records [5] offer critical diversification benefits, underpinned by an exposure to inflation and GDP factors [6], making them a valuable component of any diversified investment strategy, in InfraRed’s view.

Authored by:

Gianluca Minella

Head of Research

References

[1] Infralogic, as at December 2024. Past performance is not a guide for the future.

[2] Transport accounts for c. 38% of the Edhec Infra300 index as at March 2025. Scientific Infra™ and Private Assets, used under permission data. Past performance is not indicative of the future.

[3] Macrobond, S&P Global, Dow Jones Brookfield, as at December 2024.

[4] Based on InfraRed Capital Partners interactions with long-term investors.

[5] Based on a number of sources, including S&P Global, Dow Jones Brookfield, Scientific Infra™ and Private Assets, as at March 2025.

[6] MSCI Private Infrastructure Model.

InfraRed has based this document on information obtained from sources it believes to be reliable, but which have not been independently verified. All charts and graphs are from publicly available sources or proprietary data. Except in the case of fraudulent misrepresentation, InfraRed makes no representation or warranty (express or implied) of any nature or accepts any responsibility or liability of any kind for the accuracy or sufficiency of any information, statement, assumption or projection in this document, or for any loss or damage (whether direct, indirect, consequential or other) arising out of reliance upon this document. InfraRed is under no obligation to keep current the information contained in this document.

You are solely responsible for making your own independent appraisal of and investigations into the products, investments and transactions referred to in this document and you should not rely on any information in this document as constituting investment advice. This document is not intended to provide and should not be relied upon for tax, legal or accounting advice, investment recommendations or other evaluation. Prospective investors should consult their tax, legal, accounting or other advisors. Prospective investors should not rely upon this document in making any investment decision.

Investments can fluctuate in value, and value and income may fall against an investor’s interests. The levels and bases of taxation can change. Changes in rates of exchange and rates of interest may have an adverse effect on the value or income of the investment or any potential returns. Figures included in this document may relate to past performance. Past performance refers to the past is not a reliable indicator of future results. There can be no assurance that the opportunity will achieve its target returns or that investors will receive a return from their capital. Investment in the products or investments referred to in this document entails a high degree of risk and is suitable only for sophisticated investors who fully understand and are capable of bearing the risks of such an investment, including the risk of total loss of capital originally invested. It may also be difficult to obtain reliable information about the value of these investments, which will often have an inherent lack of liquidity and will not be readily realisable.

This document is being issued for the purposes of providing general information about InfraRed’s services and/or specific assets and their operational performance only and does not relate to the marketing of investments in any alternative investment fund managed by InfraRed.

InfraRed may offer co-investment opportunities to limited partners, or third parties. These circumstances represent conflicts of interests. InfraRed have internal arrangements designed to identify and to manage potential conflicts of interest.

This document should be distributed and read in its entirety. This document remains the property of InfraRed and on request must be returned and any copies destroyed. Distribution of this document or information in this document, to any person other than an original recipient (or to such recipient’s advisors) is prohibited. Reproduction of this document, in whole or in part, or disclosure of any of its contents, without prior consent of InfraRed or an associate, is prohibited.

This document is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation.

InfraRed Capital Partners is a part of SLC Management which is the institutional alternatives and traditional asset management business of Sun Life.

Owing to regulatory requirements, certain content on this website won't appear to users resident in the United States (US).

Are you resident in the US?

We use cookies to ensure the proper functioning of this site, and to carry out internal analysis on the use of the site by our visitors. By clicking “Accept” you will accept our recommended settings for cookies in addition to accepting our terms and conditions and go directly to the site. Alternatively, you can click “Accept and opt-out of cookies” to accept the terms but opt out of cookies. Or, you can click “settings” to review the terms and conditions.